Compare and choose the credit card for you in Norway

Instapay

Mastercard

The new credit card from Instabank is one of the lowest interest rate cards on the market: just 14.9%.

Benefits of the Instapay Mastercard

Conditions for applying for Instapay Mastercard:

Nominal interest rate:

14.9%

Effective interest rate:

18.13%

Currency conversion fee:

2%

Term fee:

40 kr

Annual fee:

0 kr

ATM withdrawal:

50 kr per transaction

Card setup fee:

0 kr

Purchases in Norway / abroad:

0 kr

nom. rente 14,9%, eff. rente 18,13%, 45 000 kr, o/1 år, kostnad: 4 194 kr, totalt: 49 194 kr

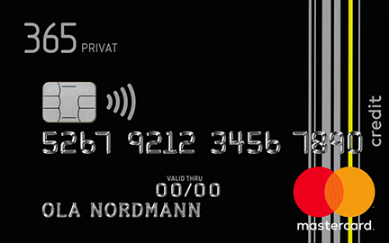

365Direkte MasterCard

Fuel Card

One of the best fuel cards in Norway. It is completely free, and with Cashback, you get money back every time you use the card at gas station networks and 30 to 34 øre discount per liter every time you pay for fuel.

365Direct MasterCard offers a range of benefits:

365Direkte is a unit within Danske Bank, DealPass discounts are also included with the credit card. This means that with the 365Private credit card, you get 10-25% discount at hundreds of stores, restaurants, etc.

Free credit card!

Applying for the card costs nothing, owning the card is free, and a fee only applies if you opt for a paper invoice. You get up to 45 days interest-free, provided you repay the outstanding amount on time.

Credit card with online banking

Since the credit card comes with online service, you always have insight into what you use your card for. This gives you extra security and control every day. You can also download the Danske Bank mobile bank to view your expenses when you are on the go.

Effective interest rate:

25.53%

Annual fee:

0 kr

Purchases:

0 kr

Electronic invoice:

0 kr

Paper invoice:

45 kr

Currency conversion in Europe and outside Europe:

2%

Fee for cash withdrawals at ATMs and bank counters:

40 kr + 2% of the withdrawal amount

Overdraft fee:

100 kr

25.53%, 15,000 o/12 months, total 16,929

Resurs Bank

Supreme Card Gold

A flexible and secure credit card that you can use for purchases. You receive the invoice a month after your purchases and decide yourself whether you want to pay the full amount immediately or spread the repayment over a longer period.

Benefits of the Supreme Gold card:

Conditions for obtaining a credit card:

Effective interest rate:

26.25%

Annual fee

0 kr

Cash withdrawal:

1.95% of withdrawal (min. 35 NOK)

Card setup fee:

0 kr

Purchases abroad:

1.95% of purchase amount

15 000 kr o/12 mnd, eff. rente 26,25%, kostnad 1 925 kr, totalt 16 925 kr

Komplett Bank

Kredittkort

A credit card that gives bonuses and many benefits when shopping online.

Komplett Bank MasterCard - benefits:

Conditions for obtaining Komplett Bank MasterCard:

Annual nominal interest rate for goods purchases:

21.4%

Annual nominal interest rate for cash withdrawals:

24.9%

Currency conversion fee:

1.75%

Term fee

40 kr

Annual fee:

0 kr

ATM withdrawal in Norway and abroad:

0 kr

Card setup fee:

0 kr

Purchases:

0 kr

Eff.rente 24,2%, 12 000,- o/12 mnd kostnad: 1 468, totalt: 13 468